In May, the Department of Treasury released much anticipated guidance on the Domestic Content Adder, the tax credit included in the Inflation Reduction Act (“IRA”) which is designed to strengthen the United States’ solar equipment manufacturing industry.

For solar developers like us at UGE, this critical guidance answered key questions, allowing us to move ahead with plans to capitalize on the Domestic Content Adder for most of our projects going forward.

In this guide, we’ll summarize the criteria for qualifying for the Domestic Content Adder, explain how to calculate the domestic content make-up of a project using the Adjusted Percentage Rule, and provide an illustrative analysis of the calculation for a community or commercial-scale project.

Domestic Content Adder Criteria

The Domestic Content Adder is rewarded to developers via either a 10% Investment Tax Credit (ITC) Adder, or a $0.03/kWh Production Tax Credit (PTC) Adder. , for community and commercial solar, the ITC will almost always prove more favorable because of the higher average off-take rates for these types of projects.

It is also important to note that – at least as of now – the criteria for qualifying for the ITC versus the PTC will diverge over time. As currently written, the IRA outlines that t

At the highest level, to qualify for the Domestic Content Adder, all structural components used in the projects must be 100% domestic content, while the manufactured components must be comprised of at least 40% domestic content. The general breakdown of structural versus manufactured products is as follows:

- Structural Components: Steel within racking products is classified as structural components and the steel must be 100% manufactured in the US. Driven piles and ground screws in ground mounted tracker-based racking are considered structural components, alongside the entirety of a steel fixed tilt or rooftop racking system. If a racking system is made of aluminum instead of steel, however, it is considered a manufactured product.

- Manufactured Components: Manufactured components consist of the rest of the project that isn’t considered a structural component. This includes the tracker portion of a ground mount system. As noted above, racking systems made of aluminum are also considered manufactured components. The breakdown of these materials will determine the domestic content percentage on a project.

Using the Adjusted Percentage Rule

To allow developers to calculate the amount of domestic content within the manufactured components of any given project, the Department of Treasury released a tool called the Adjusted Percentage Rule. The Adjusted Percentage Rule divides the cost of the domestically manufactured products and components by the total cost of manufactured products to determine the domestic cost percentage for a project. The domestic and total manufactured product costs only include direct material and direct labor costs in their totals. These costs are obtained from cost sheets provided by vendors.

To calculate the domestic content percentage, simply add together the percentages next to the product components manufactured, as opposed to assembled, in the United States. (Manufacturing involves altering the form or function of parts and raw materials by “adding value and transforming” them into a new product “functionally different from that which would result from mere assembly.”) The domestic content percentages are provided starting on page 15 of the IRS Safe Harbor and Adjusted Percentage Rule guidance.

The below example is for a grid-scale BESS calculation:

- If the cells, packaging, and thermal management system are made in the United States, but everything else is imported, the domestic content percentage is 38.0 + 3.3 + 4.9 = 46.2%.

- If the battery packs as well as all four components used to make them are manufactured in the United States, then the “production” number is also added to the percentage. In that case, the domestic content would be 38.0 + 3.3 + 4.9 + 5.2 + 21.1 = 72.5%.

- If some of the cells are made in the United States and some are imported, then only a fraction of the 38.0 for cells counts. For example, if 60% of the cells are US-made and 40% imported, then 38.0 x 60% = 22.8% would be credited to domestic content.

- If a component is not used in the product, then it is ignored.

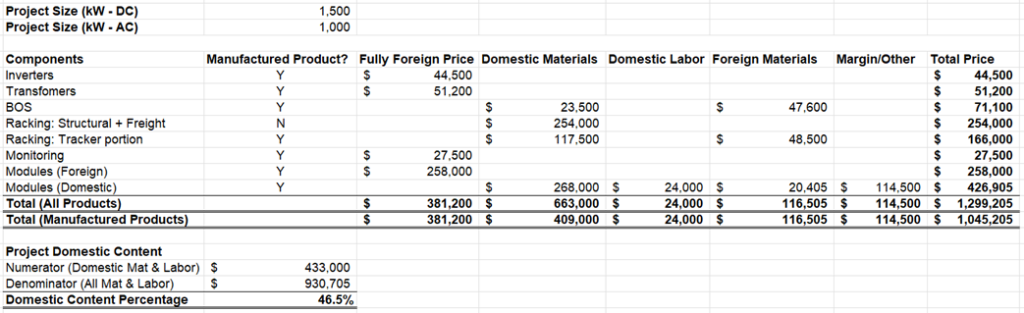

The sample analysis below for a hypothetical community solar project provides an applied example of Adjusted Percentage Rule calculations:

Sourcing Domestic Content

According to SEIA, as of mid-July 2024 the U.S. currently has 167 GW of solar module manufacturing capacity and 175 GW of battery storage component manufacturing currently operating, under construction, or announced. While the industry still has a way to go until it is able to meet demand, growth has skyrocketed since the 2022 passage of the IRA, with new manufacturing plants and investment being announced constantly.

SEIA’s Solar & Storage Supply Chain Dashboard includes a live and interactive map presenting domestic manufacturers by product type and facility status – a useful resource for developers looking to form partnerships with domestic producers.

Many suppliers of PV modules, racking, and other manufactured components are offering or plan to offer products with at least some percentage of U.S.-made content, which when balanced within the total equipment makeup of a project can be used to reach the 40% domestic content minimum.

Our Approach: Long-Term Contracting

At UGE, we are pleased to have recently signed an MSA with North American solar manufacturer Heliene to source 93% U.S.-made modules, which we will begin using in our projects under construction as early as this fall. By guaranteeing the supply and domestic percentage of the modules we will use moving forward, we can balance the remainder of our equipment procurement to ensure we meet the requirements of the Domestic Content Adder.

In addition to allowing us to secure modules with the domestic content percent we need, our long-term contract with Heliene significantly reduces our supply chain risk. With anticircumvention lawsuits and geopolitical tensions creating uncertainty and delays in the solar supply chain, the benefits of domestic supply grow even clearer. Heliene is a company we’ve worked with for more than ten years, dating back to the days of the Ontario feed-in-tariff market, and one we look forward to working with for years to come.

Growing Domestic Solar Manufacturing

While there will be growing pains as supply chains develop to meet ever-increasing demand, a strong domestic solar manufacturing industry will significantly benefit solar developers, the U.S. economy, and an expedient and just transition to renewable energy in our country. Some of the most important reasons UGE supports investing in domestic solar manufacturing include:

- Job Creation: Expanding domestic manufacturing generates employment opportunities, fostering economic growth and stability within the U.S. Much of this job creation will take place in jurisdictions that have historically been more resistant to the renewable energy transition; as the clean energy industry begins to directly benefit these local economies, general attitudes on the issue can be expected to improve.

- Environmental Impact Mitigation: By reducing reliance on international supply chains, the U.S. minimizes the environmental footprint associated with cross-continental transportation of equipment.

- Enhanced Oversight: Domestic production enables stricter regulation and oversight, ensuring adherence to higher standards of human rights and environmental protection throughout the manufacturing process.

- Risk Mitigation and Energy Security: Decreasing reliance on foreign sources mitigates geopolitical risks and bolsters national energy security by fostering a more resilient and self-reliant energy infrastructure.

We encourage all solar developers to explore ways in which they can support domestic production so we may all benefit from a more secure and humanitarian energy transition.